How to Change the HDFC Credit Card Billing Cycle

If you have an HDFC credit card, the dates for when you get your bill are usually fixed. But guess what? You can change those dates if you want to! Although the My Cards app used to let you do this online, it’s temporarily unavailable. No worries, though – you can still get it done in less than 10 minutes by giving customer care a quick call.

In the past, changing billing cycles for certain credit cards was a bit of a hassle. But now, thanks to a new rule from the RBI, all credit card companies, including HDFC Bank, have to let you do it online. So, if you want your credit card dates to match your preferences better, it’s now super easy to make that happen!

How to Change HDFC Credit Card Billing Cycle

When you get your HDFC credit card bill and now if you want to change the billing cycle, just call 1800-202-6161, press 9 after connecting to the card section, and chat with a customer care agent.

Choose a new date for your bill, but avoid the first three and last three days of the month. After the call, you’ll get a confirming text.

A few things to keep in mind:

- Changes take about 40-45 days to kick in.

- Figure out your current billing date before picking a new one.

- Don’t go for the dates 1-3 or 28-31, as per HDFC’s rules.

- Your new billing date applies to all your HDFC credit cards, even the extra ones.

Similar reads:

- HDFCMyCards: Manage Cards with HDFC Bank’s New Web App

- How to open the HDFC credit card statement password (PDF)

- Understanding IGST 18 Charges on Your Credit Card Statement

How to Change HDFC credit card billing cycle date online

As of the first quarter of 2023, the option to change your HDFC credit card billing cycle date online is not available on MyCards. However, if HDFC Bank reinstates this feature in the future, you can follow these steps using the HDFC My Cards Progressive Web App (PWA) to make the change. Keep in mind that the changes won’t happen right away and may take a few months for the new billing cycle to take effect.

Please check the My Cards app or contact HDFC Bank for the most up-to-date information regarding the availability of the online billing cycle change feature.

1. Open the HDFC My Card web app and sign in to your account.

Firstly open your mobile browser and enter this URL: mycards.hdfcbank.com. Then log in to your account with your registered mobile number.

2. Select a credit card and open the card summary

Now go to the credit cards section and select a card for which you want to change the billing cycle.

Then click on the “Card Summary” that allows you to change the billing date.

3. Changing the billing date

On this page, you will find a link to change the “Statement Generation Date“.

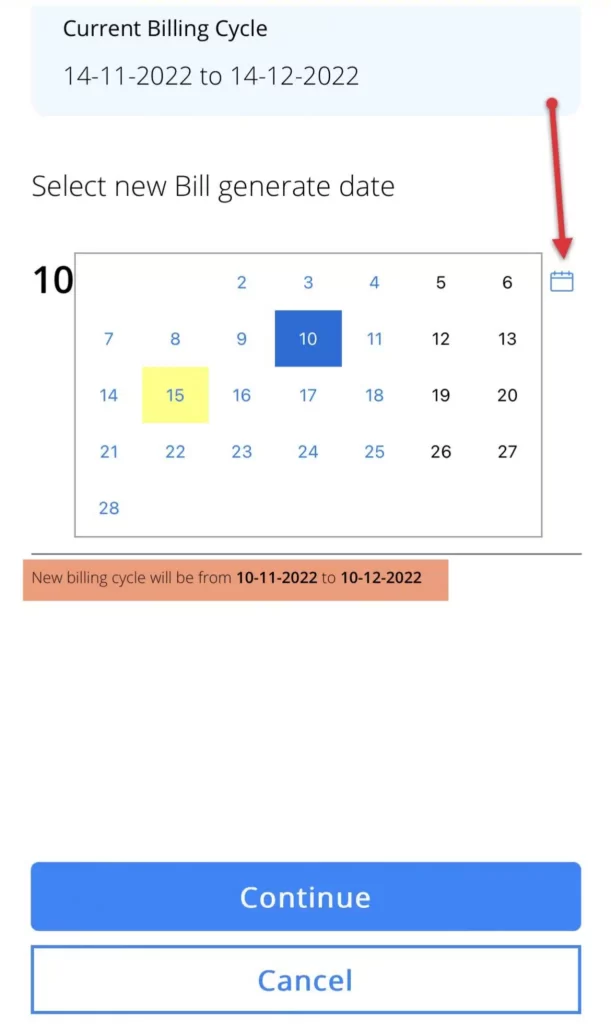

4. Choose a new billing cycle

You may now see the current billing cycle for your HDFC credit card. Tap on the calendar icon, as shown in the screenshot, to choose a new billing period. Then, select a date (I chose the 10th) and push the Continue button to confirm the change.

Take note of the reference number generated by the My Card app after submitting the request. If your complaint has not been handled within the time frame specified, you may contact HDFC Bank credit card customer service.

Why does someone wish to change the billing cycle?

Individuals may wish to change their credit card billing cycle for various reasons, depending on their financial needs and preferences. Here are some common reasons why someone might consider changing their billing cycle:

- Aligning with Salary Dates:

- Some individuals prefer their credit card billing cycle to align with their salary payment dates. This can make it more convenient to manage payments and ensure that there are sufficient funds available to cover the credit card bill.

- Cash Flow Management:

- Changing the billing cycle can help individuals better manage their cash flow. They may choose a billing cycle that aligns with their income patterns, making it easier to budget and pay off their credit card balance on time.

- Coordination with Other Bills:

- Coordinating the credit card billing cycle with other monthly bills can simplify financial planning. By having all bills due around the same time, individuals can streamline their payment schedules and avoid overlooking any payments.

- Due Date Preferences:

- Some individuals prefer a specific due date for their credit card payments based on their financial situation. Changing the billing cycle allows them to select a due date that suits their preferences and ensures timely payments.

- Consolidation of Payments:

- Individuals with multiple credit cards may choose to synchronize billing cycles to consolidate payments. This can simplify financial management by having all credit card bills due at the same time.

- Budgeting and Planning:

- Changing the billing cycle provides an opportunity for better budgeting and financial planning. Individuals may prefer a billing cycle that aligns with their budgeting cycles, making it easier to track and control their expenses.

- Travel or Seasonal Considerations:

- For those who travel frequently or have seasonal variations in income, adjusting the billing cycle can be beneficial. It allows them to better plan for expenses during specific periods, such as holidays or travel seasons.

- Credit Card Rewards Optimization:

- Some credit card users may want to align their billing cycle with the timing of credit card rewards or cashback programs. This way, they can maximize the benefits offered by their credit card during a specific period.

It’s important to note that not all credit card issuers may allow customers to change their billing cycle, and there could be certain terms and conditions associated with such requests. Individuals interested in changing their billing cycle should contact their credit card issuer for specific information and guidance.

Conclusion

Most banks, including ICICI, have integrated credit card billing cycle change requests via online banking and mobile apps. This feature was also accessible on HDFC Bank’s MyCards web app, however, it was deleted without notice to clients. Fortunately, we can still request a statement date change through customer service for free and quickly. Our ultimate hope is that HDFC reactivates the online alternative, which some consumers prefer over calling customer care.