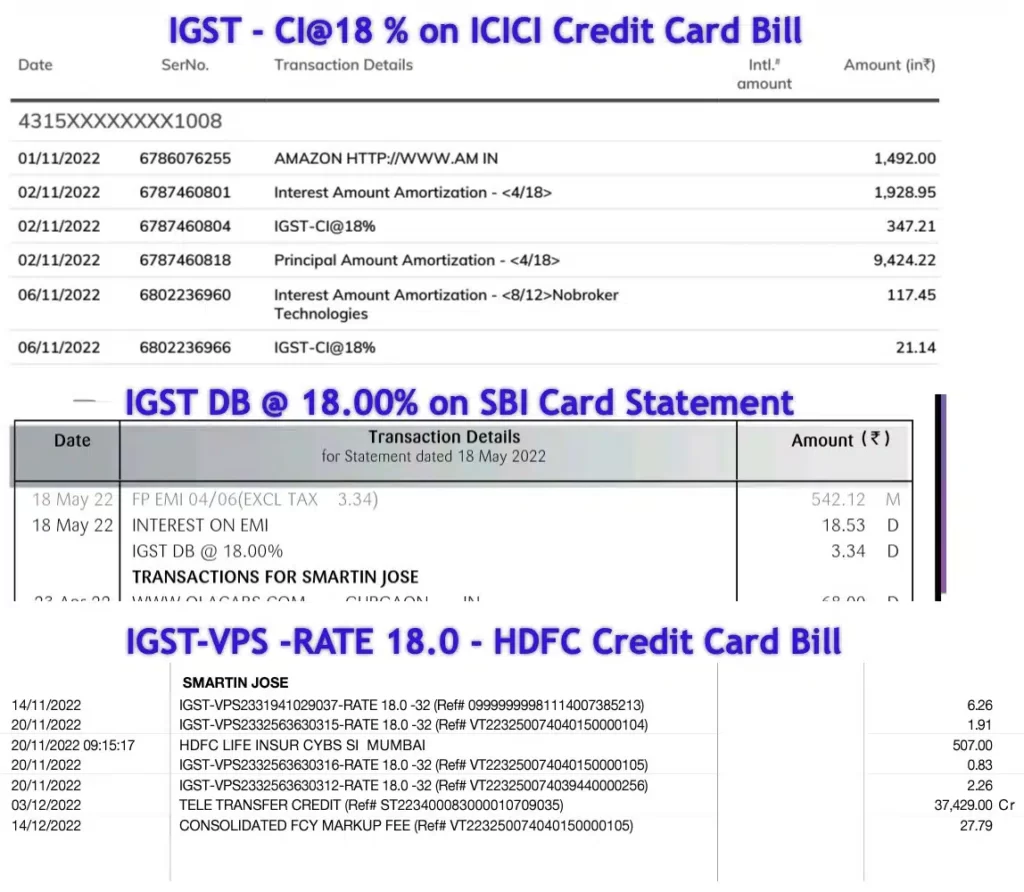

If you’ve ever noticed entries like “IGST-VPS-RATE- 18 (HDFC), IGST CI@18 (ICICI), IGST DB @18.00 (SBI),” or an unfamiliar GST charge on your credit card statement, you might wonder about its origin and significance.

Reason for IGST VPS RATE-18, CI@18, DB@ 18.00 (GST Charges) on Credit Card Statement

In simple terms, the “IGST charges” on a credit card bill represent a tax deduction collected and remitted to the government. The prevailing GST rate for financial services, including credit cards, is 18%, reflecting on monthly statements for qualifying transactions. The IGST 18 collected is distributed between the State and Central governments as CGST and SGST.

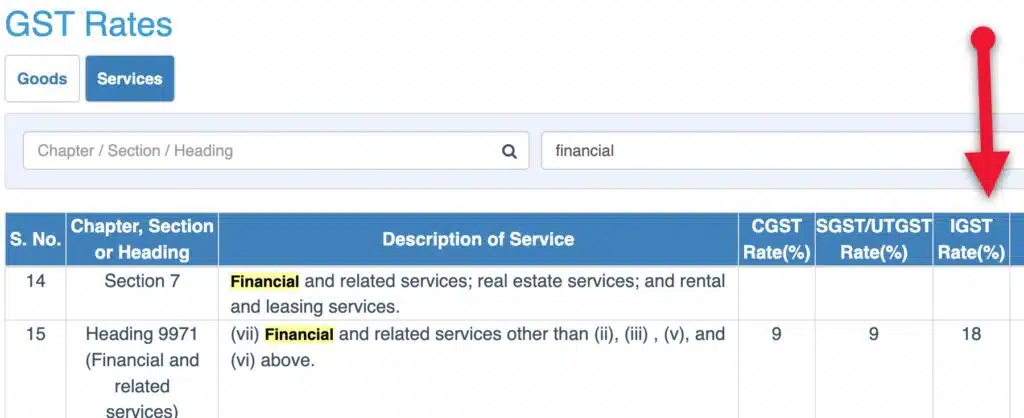

IGST Slab for Credit Cards and Banking Services:

Under the GST tax regime in India, businesses must contribute a share of their gains from financial services to the government. Refer to the screenshot from the CBITC website for details on IGST applicable to Banks.

If you take a loan, EMI, or incur associated fees, credit card issuers deduct an additional 18% as GST charges. Refer to the table below to understand the credit card service categories subject to IGST charges.

| GST Charge Code | Bank Name | Amount Charged | IGST Charge Applicable On |

|---|---|---|---|

| IGST VPS RATE -18.0 | HDFC Bank | 18% (including SGST+ CGST) | Credit card annual/membership Fee, Joining Fee, Cash advance fee, Late Fee, EMI processing Fee, reward points redemption fee, Foreign currency (FCY) Mark-up fee, Interest part of finance charges, Insta Loan, SmartEMI, Merchant EMI conversion, balance transfer on EMI, No-Cost EMI, etc. |

| IGST CI@18% | ICICI Bank | ” | Personal Loan on Credit Card (PLCC), EMI on Call, etc. |

| IGST DB @18.00% | SBI Cards | ” | Encash, Flexy Pay, Easy Pay |

| IGST | Standard Chartered Bank (SCB), OneCard, Kotak Bank, IDFC bank | ” | Pre-approved Instant Loan/Cash on credit Card, OneCash, and other products |

| GST | RBL Card, Axis Bank, Federal Bank, American Express, IndusInd Bank | ” | Charged on the interest component of all credit card-based loans and for all service fee categories mentioned above. |

While some credit card loans include GST in the installment, most banks do not specify GST charges during online/offline purchases converted to EMI. Consequently, entries like IGST-VPS RATE 18, IGST CI @18%, and IGST DB may surprise customers, particularly those availing schemes like no-cost EMI, as few know that fees for credit card-related services exclude IGST.

Similar reads:

- HDFCMyCards: Manage Cards with HDFC Bank’s New Web App

- How to open the HDFC credit card statement password (PDF)

- How to Open an e-Aadhar File Using Aadhar Card Password

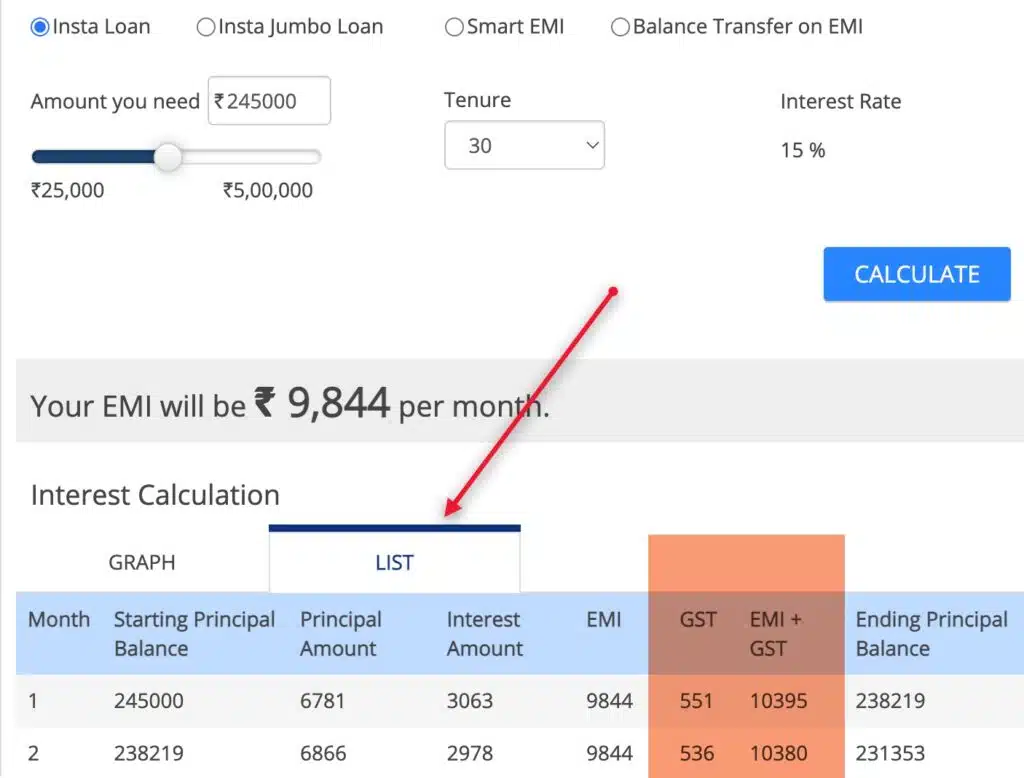

How to Calculate IGST 18 Charges for Credit Card Loan or EMI:

For calculating IGST charges on credit card loans & EMIs, consider using Axis Bank’s personal loan calculator. Input your EMI/Loan details, adjust sliders, and copy the generated interest rate. Calculate 18% of that amount to determine the IGST charge for the month. HDFC Bank also offers an online tool displaying monthly IGST amounts for credit card-related products.

Why is There SGST & CGST in My Credit Card Bill, and How is it Different from IGST?

Some banks split IGST charges as SGST (State) and CGST (Central), each calculated at 9%, displaying them separately on the credit card bill. However, the total implication for the customer remains the same.

Can I Get a Refund of GST Amount Charged on Credit Card?

Refunds for IGST charges are not possible unless the transaction is canceled or service fees are reversed.

Do Banks Charge IGST on No-Cost EMI?

For No-Cost EMI, banks discount only the total interest amount upfront, excluding the GST amount, which customers need to pay monthly in addition to the EMI.

How Can I Avoid Getting GST Charges on My Credit Card?

While you can’t eliminate IGST charges, you can minimize them by avoiding EMIs, opting for a lifetime free credit card, and choosing cards with low service charges. Foreign currency transactions should be conducted with cards featuring low FCY.

Why Do Some Banks Use Terms Like IGST VPS, DB, CI, etc., on Credit Card Statements?

Banks use these terms interchangeably to indicate IGST charges at 18%, with State GST Codes sometimes added at the end of the transaction details.

As a banking expert, understanding these intricacies can help you navigate your credit card statements more effectively.