HDFCMyCards: Manage Cards with HDFC Bank’s New Web App

HDFCmyCards, a web app from HDFC Bank, provides customers with a seamless way to view summaries of their cards, loans, FASTag, and more while enabling on-the-go control of their settings.

Managing credit card accounts is now more straightforward than ever with My Cards by HDFC Bank. The app operates effortlessly on any mobile device without requiring installation or activation.

Whether you need to swiftly block a card, reset the PIN, access card controls, or check loan statements, HDFCmyCards is designed for your convenience. Click the button below to experience the ease of managing your financial products on MyCards.

Login to HDFCMyCards App

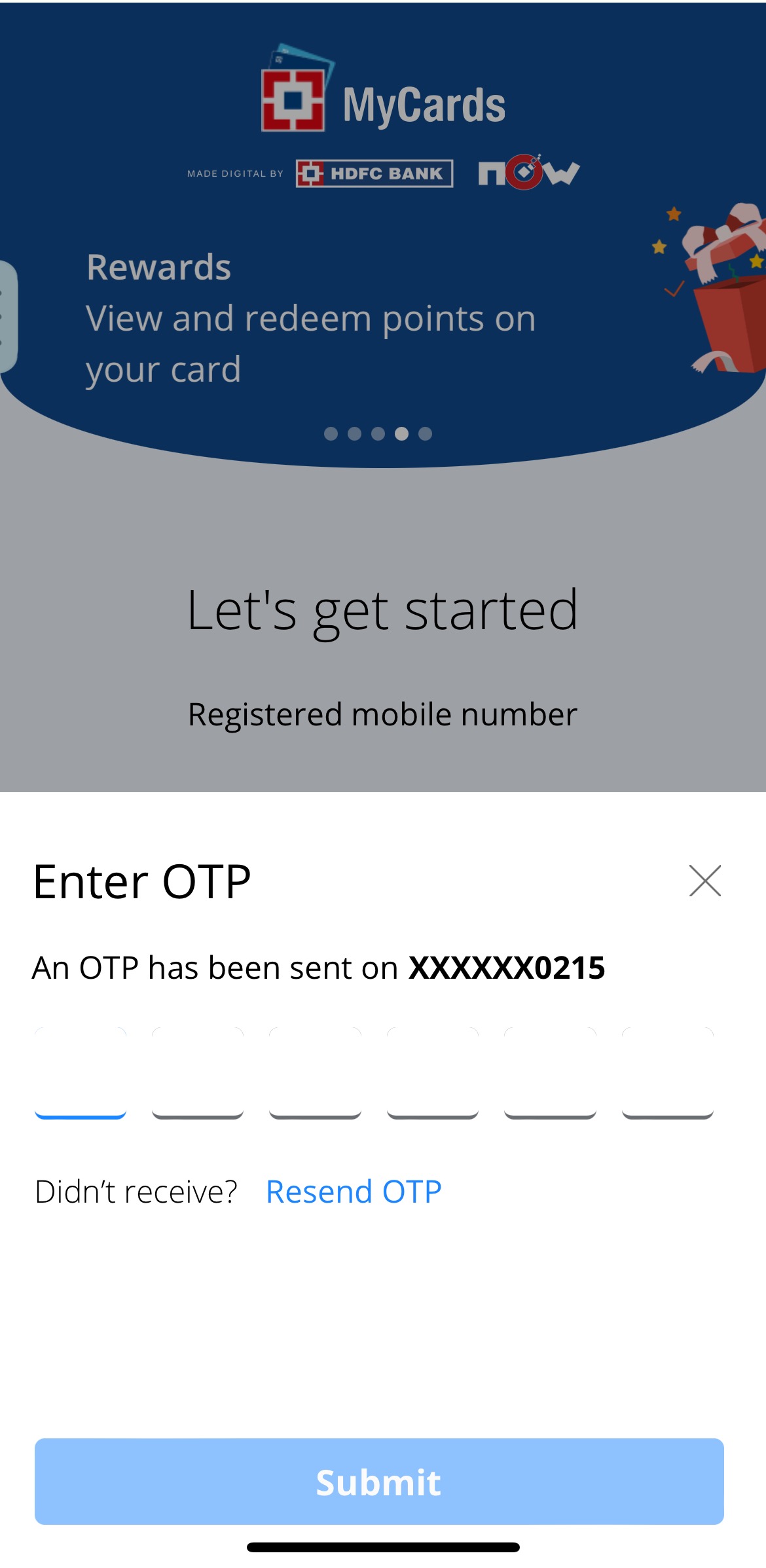

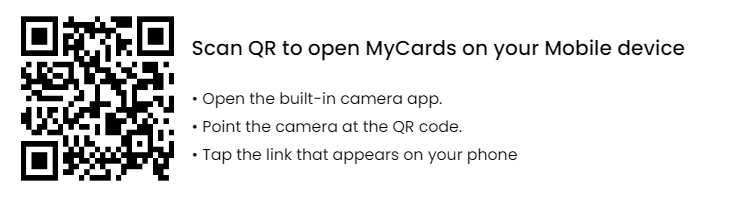

Customers have three convenient options to access the MyCards app: click the button below, scan the QR code, or visit mycards.hdfcbank.com using a mobile browser. Afterward, use your HDFC Bank registered phone number to generate an OTP. Once logged in, add details of your HDFC Credit Card, Debit Card, Debit Card EMI, Consumer durable loan, or FASTag to access individual product settings.

Please note that HDFC Bank has recently disabled sign-in to My Cards through desktop access. Therefore, it is recommended to use a mobile browser to access the provided link.

Direct Link: HDFC MyCards

Manage HDFC Credit Card & Control Settings using My Cards App

Upon your first login to HDFCMyCards, the home screen may appear empty. Follow the steps below to add a new credit card to the My Cards app and control its settings. This process is applicable for debit cards, loans, and FASTag as well.

- Log in to the app at mycards.hdfcbank.com: Enter your phone number associated with HDFC Bank on the login window and sign in to the My Cards App using OTP verification.

- Tap on the Add (+) button at the footer: Locate the ‘Add (+)’ button in the bottom section of the HDFCMyCard’s UI and click on it.

- Select the credit card from the available product options: Choose the first icon to add a credit card. You can also select a debit card, a debit card EMI, a consumer durable loan, or a FASTag. Start a new instance for each item, then click submit after accepting the Data Privacy consent.

- Enter Identification details for your Card, Loan, or FASTag: Provide the last four digits of your card number, account number, DOB, etc. for loans and debit cards. Fill in the required fields and press the ‘Add’ button.

- Click ‘Done’ to manage HDFC card controls on mycards: This process allows you to see the added product on the app’s home screen, with access to its settings.

If you have multiple credit cards, slide right or left on the MyCards UI to navigate among them. Credit cards, debit cards, loans, and FASTag will be displayed as tabs at the top under the MyCards logo.

Similar reads:

- How to Find Your Axis Bank Customer ID

- What is Lien Amount in State Bank Of India (SBI) Account?

- How to open the HDFC credit card statement password

What is My Cards? Is it HDFC’s Credit Card App?

HDFC MyCards is more than just a credit card app; it’s a platform to manage various HDFC Bank products in a simplified manner. It distinguishes itself from a mobile app both technically and in various aspects. While the HDFC Mobile Banking app requires device activation with a user ID and debit card number, MyCards eliminates this need. Instead, you can install it on your phone as a web app.

Install HDFC My Cards App on a Phone

As a Progressive Web App (PWA), HDFCMyCards can be installed on both Android devices and iPhones without using the App/Play Store. Open default browsers, Safari (iOS) or Chrome (Android) on your phone and navigate to the My Cards Portal. On iPhone, click the Share button, then select ‘Add to Home Screen.’ On Android, tap on the three dots (Menu) in the upper right corner, scroll down, and click ‘Install app.’

With the introduction of MyCards, HDFC Bank credit card customers now enjoy greater convenience. While HDFC Bank has had a mobile app (iOS & Android) for years, customers without a savings bank account had to rely on HDFC’s credit card net banking. As most customers now use mobile devices, HDFC My Cards addresses this need for quick and efficient resolution.

Once installed, My Card’s icon will be added to your phone’s springboard, as shown in the screenshot. From now on, you can click on this icon to quickly manage your credit card.

Things you can manage with the HDFCMyCards app

My Cards offers HDFC credit card holders a one-stop solution without the hassle of device activation or remembering account credentials.

- HDFC Card Control settings available on My Cards:

- Check the summary of transactions on all HDFC credit cards.

- View existing EMIs and their status.

- Enable or disable online & offline payments, including tap & pay, international transactions, and ATM withdrawals.

- Check the billed amount and download the credit card statement (PDF).

- Cancel, block, and reissue a card.

- Set a new credit card PIN.

- View rewards points and redeem them externally.

- Change the billing cycle of an HDFC credit card (suspended for now).

- Apply for a new UPI credit card/Add-on Cards.

- Check the limit, enhance it, and also upgrade the card if eligible.

- Card token management.

- Debit Card management options:

- Enable or disable Domestic and international usage, ATM withdrawal, Merchant transactions, and Tap and pay.

- Instantly block the debit card.

- Set a new debit card PIN (link to HDFC Insta service website).

- FASTag:

- View your HDFC bank-issued FASTag’s balance and vehicle information.

- Access the latest transactions.

- Option to reissue the Tag and recharge the wallet (link).

- Consumer Durable Loan & Debit Card EMI:

- Loan account Statement: past transactions and remaining dues.

- Check the Debit card EMI schedule and payment dates.

FAQs

1. How can I download my HDFC Credit Card statement without logging into net banking?

- Answer: MyCards is your solution for hassle-free downloading of the original digitally-signed HDFC credit card statement (PDF) without needing net banking credentials. Sign in to My Cards by providing your phone number. Once logged in, click on the ‘E-Statement‘ icon on the home page. Select the desired month, input your email, and click the button to download the statement.

2. How to control the per-transaction limit for HDFC Credit Card?

- Answer: MyCards simplifies the management of HDFC credit card transaction limits. On the home page, click on the ‘Card Control‘ link. Here, you can disable international, local, and merchant transactions, as well as ATM withdrawals and NFC Tap & Pay. You can set per-transaction limits and toggle each type of transaction on or off using slider controls. Click the “Change” label, input your new upper limit, and click ‘Update‘ to apply the changes.

3. How to generate a credit Card PIN using the HDFC MyCards app?

- Answer: To generate a credit card PIN using HDFC MyCards, log in to the app, and on the front page, you’ll find a ‘SET PIN‘ option. Click on it, input the desired PIN twice, card expiration date, and CVV. Click ‘Continue,’ and an OTP will be triggered. Verify it, and you will receive an on-screen message confirming that your new PIN has been changed/generated successfully.

4. Can I remove a credit card from hdfcmycards app?

- Answer: Yes, you can remove products (cards, loans & FASTag) from HDFC My Cards. Navigate to ‘My Profile’ by clicking on the ‘More’ tab at the right corner of the footer row. Then select ‘My Profile’ and choose ‘Linked Products‘ from the dropdown menu. Pick the item you want to unlink and click the ‘Remove’ link.

5. How can I manage addon card settings on hdfmycards?

- Answer: Addon cards can be managed from the ‘Card Control’ section of the My Cards app. Click on the drop-down menu labeled ‘For‘ near the middle part of the app. You’ll find the addon card and the holder’s name; select it to access its controls.

6. How to block an HDFC credit card online without calling customer support?

- Answer: HDFC MyCards provides the quickest way to block your credit card online. Log into MyCards, click on the ‘Block‘ symbol, and select either ‘Lost/Stolen’ or ‘Damaged.’ The entire process of hotlisting a lost or stolen credit card takes less than 30 seconds through the app.